Web3 State of the Union

The web3 movement shows no signs of slowing down. While 2021 brought its share of downs (e.g., bitcoin summer crash, $7.1B in stealing scams, etc., ) and ups (e.g., ElSalvador adopting crypto, ETH hits 3.5B in transactions, etc., ) web3 mostly came out on top at the end of the year. And is poised for a strong 2022. As we look at the year ahead, it is worth taking stock of its current state.

This article takes a business/investment/adoption lens to the overall state of the union for web3.

1. Global crypto users doubled to over 200M (and maybe tripled?)

Based on mid-year analysis performed by cryptocurrency exchange crypto.com, global crypto users doubled from 100M to over 200M.

As you can see from the above chart, global crypto users doubled in mere six months from January to June 20201. Could it have doubled yet again from July to December 2021? We don’t know yet but we’ll surely be watching the updated stats from crypto.com. If users were to double again, that would imply a tripling of users within a single year - no simple feat if it were to pan out.

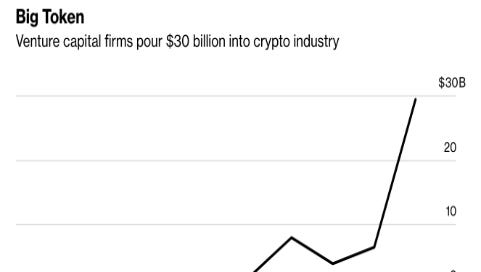

2. $30B VC poured into crypto startups, a 400% increase from 2020

Users are money-magnet. Wherever they exist, money follows. And that’s exactly what happened with VC money.

As the number of users surged, VC firms poured $30B into the crypto industry this year. As of last year, this number was around ~$7B. $30B represents a >5x or 400% increase in total VC money this year.

3. Crypto startups got >5% of total venture investments in 2021

Per crunchbase, as of Q3, 2021 saw a total of $454B global venture dollar volume. Out of this $454B, $135B in Q1, $159B in Q2 and $160B in Q3 (see chart below)

If Q4 keeps pace with Q2, Q3 (which we should know shortly once Crunchbase updates their numbers), it would put the total 2021 Global Venture Dollar Volume at $600B. Earlier we saw that crypto share was about $30B. This put crypto as a % of total VC dollar volume at ~5% (~30B / $600B); not insignificant by any means.

4. Top investors in the web3 space

Who are the key investors behind the $30B? Well, there are just too many to list in an article like this. The space is still early and super fragmented. However, the main ones are definitely worth noting and pondering over. Here they are along with their overall deal volume. (Note only includes those in the US)

It is interesting to note that other than Andreessen Horowitz, no other big names investors from the web2 world made this list. This further reinforces the point that web3 is a niche of its own and will create it’s own set of breakthrough VC firms, startups and founders!

5. Top 5 startup rounds

Which companies are attracting these investments? NYDIG was the undoubted leader when it comes to attracting capital. An inclusive financial system - with Bitcoin for all as its tag line - NYDIG, raised $1B at a $7B valuation. Forte - a blockchain gaming platform - and MoonPay - crypto payments platform - took the second the third spots with $750M and $555M raised respectively. For others who made the top 5, see the list below:

Round (in $M)

NYDIG: 1000

Forte: 750

MoonPay: 555

FTX: 425

Gemini: 400

6. Top 5 startup valuations

The valuations pretty much tracked money raised (with the exception of Forte who did not disclose their valuation). FTX, Gemini, and NYDIG were the top 3 startups with valuations at $25B, $7.1B, and $7B respectively. For others who made the top 5, see the list below:

Valuation (in $B)

FTX: 25

Gemini: 7.1

NYDIG: 7

MoonPay: 3.5

Alchemy: 3.5

7. Top 5 chains by market cap

No surprises in the top chains by market cap although it is noteworthy that Cardano which at one point rose up to the 3rd position is now no longer in the top chains. Solana continues to impress with its strong showing and may well be the chain to watch in 2022

8. Top 5 chains by TVL

Total Value Locked (TVL) continues to be a metric that remains closely watched by the industry and Ethereum is by far the leader here by a long margin. Ethereum’s TVL as a percentage of total TVL locked in crypto went down a bit this year due to the rise of other chains (e.g., Solana). That said, with such a big gap between it and the second chain, Terra, it is safe to say ETH will stay the leader for the foreseeable future.

Source: DefiLlama

9. Crypto startups raising money doubled in 2021

Per crunchbase.com, there were 700+ crypto startups that raised money in 2021. In 2020, that number stood at ~300, implying a >2x increase, which is a pretty impressive increase for a year. And if 2022 does turn out to be the year most are expecting it to be where crypto goes fully mainstream, the number of startups this year could well match or beat that increase.

In conclusion, the industry is well poised to build on the terrific momentum it achieved in 2021. With so much talent migrating from web2 to web3 and many top companies committing fully to crypto (e.g., FB, Square renaming itself to Block, etc.), 2022 may well be the breakout year that many folks are expecting. There are no guarantees though. Impending regulation, super high inflation, the possibility of a recession, etc do loom large on the crypto industry. Only time will tell how this year unfolks. We surely will be watching.